Our exclusive Forex major currency pair robots, such as EUR/USD, have been developed in two distinct categories based on investor expectations regarding capital management and risk tolerance.

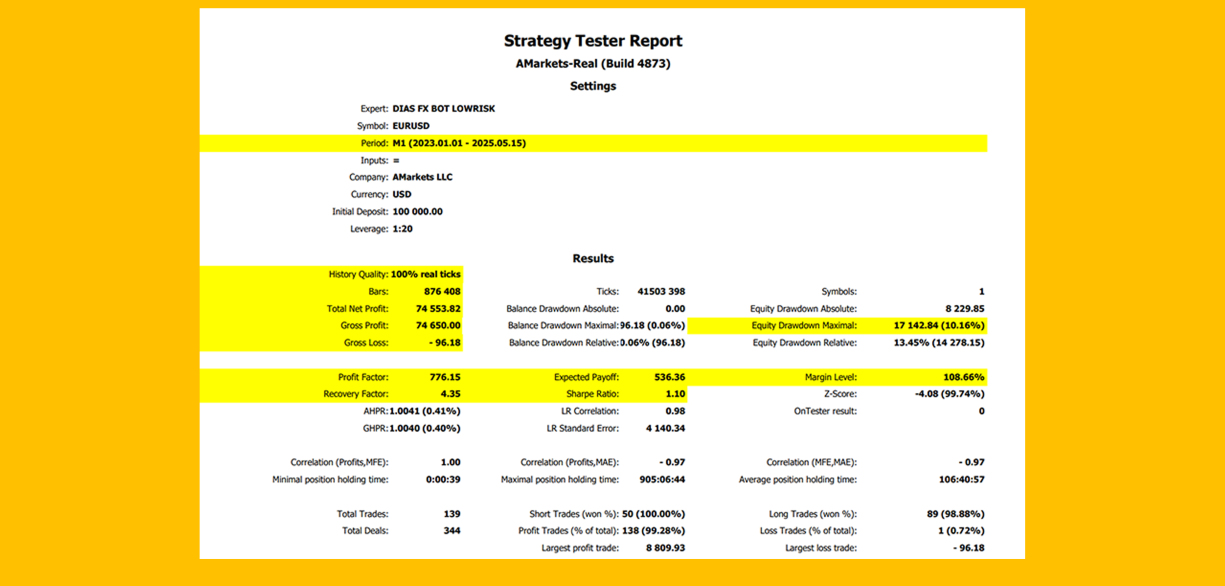

Category One:

Accounts that generally have high financial balances. Investors in this category accept a very low level of risk and expect stable, profitable returns over the long term. Therefore, the targeted profit margin is relatively low, considering the minimal risk, drawdowns, and high account balances.

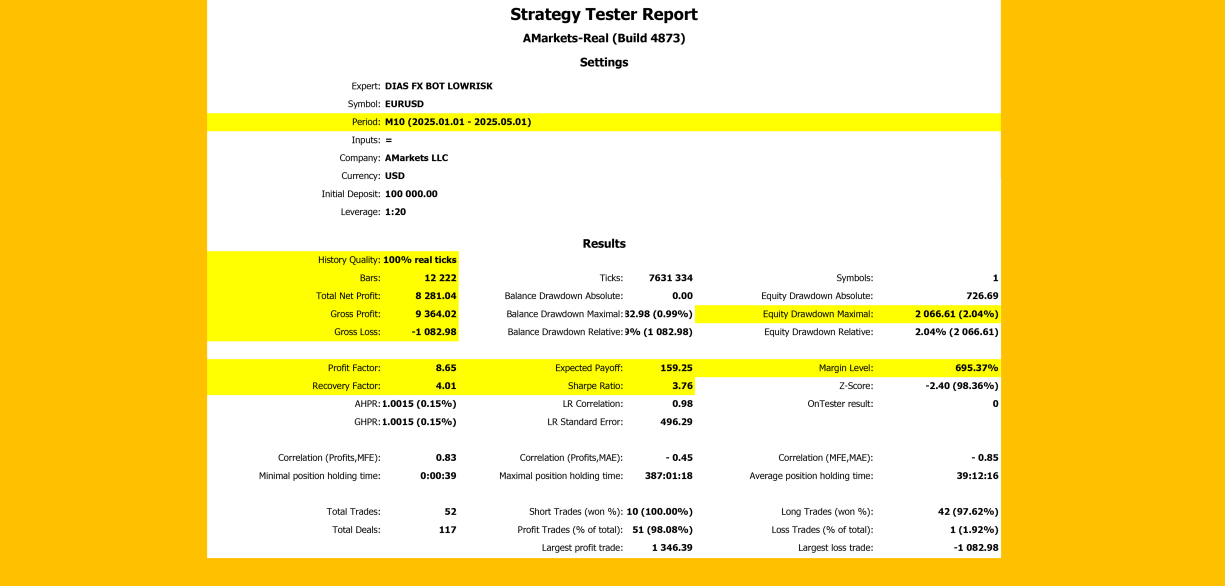

Category Two:

Accounts with relatively smaller trading capital. These investors expect higher profitability by accepting a moderate and reasonable level of risk, along with stable, profitable long-term returns. The capital management strategy of this category of robots is designed in a way that allows for compounding over a period of four to five months, generating higher profit margins.

The only difference between these two categories lies in the leverage and margin levels applied to each position. The algorithm active in high-balance accounts (ranging between $30,000 and $100,000) uses leverage below 20 and margin with a very low-risk profile. Conversely, for accounts with balances under $10,000, where a moderate risk level is defined, leverage between 100 and 200 is employed. The margin used in these trades is also three times higher than that of the very low-risk category.

The experts operating in the Forex market follow a swing trading approach in terms of time management. In some cases, the swap rate (overnight interest applied while positions remain open) is also positive.

The DIAS Group's proprietary machine learning system has recorded and compared the optimized multi-timeframe input results generated within a highly volatile price range (price channel) over a long-term period of 40 months. This volatile period for the EUR/USD currency pair occurred within a range marked by significant events and developments throughout this extended timeframe. Within this broad price range, numerous fluctuations arose due to complex and unique financial market conditions. Some of these conditions include the approval of Bitcoin ETFs in the United States, multiple interest rate stabilization moves by the U.S. Federal Reserve, the U.S.-China tariff war and Black Monday, the conflicts in Gaza and Lebanon, the Russia-Ukraine war, the banking crisis in Japan and the historic depreciation of the Japanese yen against the U.S. dollar, the oil price crash, and the historic record highs in the global price of gold.

Performance of Exclusive Forex Major Currency Pair Robots Over a 40-Month Period

The detailed trades executed by the low-risk expert advisor, for review and familiarization with this category of robots, can be accessed via the following link.